Eli Lilly (LLY)

1,009.52

-13.70 (-1.34%)

NYSE · Last Trade: Feb 22nd, 8:18 PM EST

Even a great stock has a ceiling.

Via The Motley Fool · February 22, 2026

These two healthcare stocks are likely headed higher from their current prices.

Via The Motley Fool · February 22, 2026

Growth stock ETFs offer a catch-all way to buy the dip in top stocks.

Via The Motley Fool · February 21, 2026

Market gains have left some stocks trading at expensive levels.

Via The Motley Fool · February 21, 2026

But it's good news for Eli Lilly, too.

Via The Motley Fool · February 20, 2026

Pfizer is playing catch-up in the GLP-1 drug space, but the drugmaker has a long history of success.

Via The Motley Fool · February 20, 2026

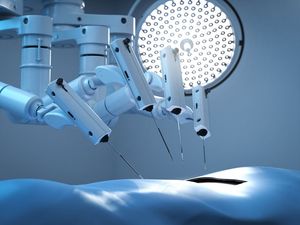

Wall Street is overly focused on GLP-1 drugs even as this medical device maker continues to thrive.

Via The Motley Fool · February 20, 2026

Eli Lilly (LLY) reports landmark Phase 3 data for Omvoh, showing over 90% of Crohn's disease patients achieved 3-year steroid-free remission.

Via Benzinga · February 20, 2026

New products are already generating growth.

Via The Motley Fool · February 20, 2026

Terns Pharmaceuticals has delivered a significant rally over the past year, lifting expectations around its clinical pipeline. The latest filing shifts attention to upcoming data and the company’s ability to support its valuation.

Via The Motley Fool · February 20, 2026

Companies that consistently increase their sales, margins, or returns on capital are usually rewarded with the best returns,

and those that can do all three for years on end are almost always the legendary stocks that return 100 times your money.

Via StockStory · February 19, 2026

These biotech companies have catalysts ahead.

Via The Motley Fool · February 19, 2026

Eli Lilly is leading the pack in the GLP-1 weight-loss drug market, but this good news won't last forever.

Via The Motley Fool · February 19, 2026

Eli Lilly just delivered explosive growth, and analysts see up to 45% upside, but is this pharma giant still a buy at its current price?

Via The Motley Fool · February 19, 2026

Novo Nordisk looks attractively priced even though 2026 is likely to be a tough year.

Via The Motley Fool · February 19, 2026

Never say never. There's certainly a mathematical path to that level, if the company navigates it correctly.

Via The Motley Fool · February 19, 2026

Any of these three pharmaceutical titans could move the needle in your portfolio.

Via The Motley Fool · February 19, 2026

NEW YORK — Pfizer Inc. (NYSE: PFE) has announced breakthrough results from its Phase 3 BREAKWATER clinical trial, demonstrating that its BRAFTOVI (encorafenib) regimen significantly improves both progression-free survival (PFS) and overall survival (OS) in patients with BRAF V600E-mutant metastatic colorectal cancer (mCRC). The data, bolstered by a fresh topline report

Via MarketMinute · February 19, 2026

Ozempic's rival is generating blockbuster revenue and gaining market share.

Via The Motley Fool · February 19, 2026

Data from Stocktwits indicated retail sentiment towards SPY and QQQ cooled to neutral.

Via Stocktwits · February 19, 2026

Expensive stocks typically earn their valuations through superior growth rates that other companies simply can’t match.

The flip side though is that these lofty expectations make them particularly susceptible to drawdowns when market sentiment shifts.

Via StockStory · February 18, 2026

Via Benzinga · February 18, 2026

Eli Lilly's latest trial results and new licensing agreement show promise in treating psoriasis, obesity, and kidney disease.

Via Benzinga · February 18, 2026

As the broader market grappled with a violent valuation reset in the technology sector, the health care industry emerged as a critical anchor for investors in early 2026. The Health Care Select Sector SPDR Fund (NYSE Arca: XLV) posted a robust 1.1% advance this week, standing in stark contrast

Via MarketMinute · February 18, 2026

In a historic moment for the global healthcare industry, Eli Lilly and Company (NYSE:LLY) has officially cemented its position as the world’s first pharmaceutical company to surpass a $1 trillion market capitalization. This monumental achievement, finalized in early February 2026, marks a paradigm shift in how investors value

Via MarketMinute · February 17, 2026