Netflix (NFLX)

78.67

+1.67 (2.17%)

NASDAQ · Last Trade: Feb 23rd, 12:10 AM EST

Rice, a former Democratic administrator, suggested that several corporations are bending the knee to the current administration, skirting policies and laws in the process.

Via Stocktwits · February 22, 2026

It is no wonder, considering this was the best January ever for ETF inflows.

Via The Motley Fool · February 22, 2026

Nu Holdings has conquered Brazil. Now, it wants the rest of the world.

Via The Motley Fool · February 22, 2026

Nearly every Wall Street analyst who covers Netflix thinks the stock is undervalued.

Via The Motley Fool · February 22, 2026

President Trump made headlines with a demand for Netflix to fire a board member and announced a tariff hike.

Via Benzinga · February 22, 2026

These three stock-split stocks still have room to run.

Via The Motley Fool · February 22, 2026

Trump calls for Netflix to remove board member Susan Rice after she made comments about political accountability.

Via Benzinga · February 22, 2026

MarketBeat Week in Review – 02/16 - 02/20marketbeat.com

If investors are waiting for less market volatility, they’ll have to wait a little longer. The markets continued to oscillate between losses and gains as investors digested the impact of the U.S. Supreme Court’s decision to strike down the emergency tariffs imposed by the Trump administration.

Via MarketBeat · February 21, 2026

Via Benzinga · February 20, 2026

Netflix has fallen harder, but Meta's latest outlook sets a much higher near-term growth bar.

Via The Motley Fool · February 20, 2026

According to a SEC filing, the 10-day waiting period under the Hart-Scott-Rodino Antitrust Improvements Act expired on February 19 after Paramount certified compliance with a Justice Department request for additional information.

Via Stocktwits · February 20, 2026

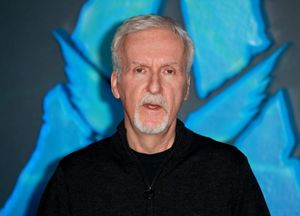

Titanic director James Cameron reportedly expressed his apprehensions about Netflix's (NASDAQ: NFLX) proposed purchase of Warner Bros. Discovery's (NASDAQ: WBD) film studio.

Via Benzinga · February 20, 2026

Philippe Laffont, a hedge fund manager with an excellent track record, sold Nvidia and bought Netflix in the fourth quarter.

Via The Motley Fool · February 20, 2026

Netflix augmented its licensing deals with its owned original content. Apple is playing follow the leader.

Via The Motley Fool · February 20, 2026

Deere Blazes Ahead, Iran Tensions Rattle Wall Streetchartmill.com

Via Chartmill · February 20, 2026

Observers worry Netflix may cut back on how many Warner Bros. movies go to theaters and instead release more of them on its streaming platform first.

Via Stocktwits · February 20, 2026

As of February 19, 2026, the media landscape stands on the precipice of its most transformative realignment in decades. Netflix (NASDAQ:NFLX) is aggressively moving forward with its $82.7 billion acquisition of the studio and streaming assets of Warner Bros. Discovery (NASDAQ:WBD), a deal that promises to unite

Via MarketMinute · February 19, 2026

The ruling pertains to Corcept’s Korlym tablets for the treatment of Cushing syndrome.

Via Stocktwits · February 19, 2026

Netflix shares trading lower on Thursday. New reports suggest the company has plenty of cash available to raise its bid for Warner Bros.

Via Benzinga · February 19, 2026

Netflix shares have been battered, but its streaming dominance remains impressive.

Via The Motley Fool · February 19, 2026

Reuters on Thursday reported, citing people familiar with the matter, that Netflix has ample cash and could hike its offer if Paramount Skydance ups its own.

Via Stocktwits · February 19, 2026

The hedge fund manager purchased more than 600,000 shares of the company.

Via Barchart.com · February 19, 2026

As of February 19, 2026, Akamai Technologies (NASDAQ: AKAM) stands as a textbook example of corporate reinvention. Once synonymous with the plumbing of the early internet—the Content Delivery Network (CDN) that allowed images and videos to load faster—Akamai has aggressively pivoted into a "cloud-to-edge" infrastructure titan. Today, the company is less of a background utility [...]

Via Finterra · February 19, 2026

Robinhood Chain is a Layer-2 network built on Ethereum, and its testnet allows users to experiment with applications before the planned mainnet rollout later this year.

Via Stocktwits · February 19, 2026

WBD shares have gained 8% in the last eight sessions as a bidding war plays out.

Via Stocktwits · February 19, 2026