Over the past six months, RenaissanceRe’s stock price fell to $237.46. Shareholders have lost 5.4% of their capital, which is disappointing considering the S&P 500 has climbed by 7.1%. This might have investors contemplating their next move.

Given the weaker price action, is now a good time to buy RNR? Find out in our full research report, it’s free.

Why Does RNR Stock Spark Debate?

Born in Bermuda after the devastating Hurricane Andrew created a crisis in the catastrophe insurance market, RenaissanceRe (NYSE:RNR) provides property, casualty, and specialty reinsurance and insurance solutions to customers worldwide, primarily through intermediaries.

Two Things to Like:

1. Net Premiums Earned Skyrockets, Fueling Growth Opportunities

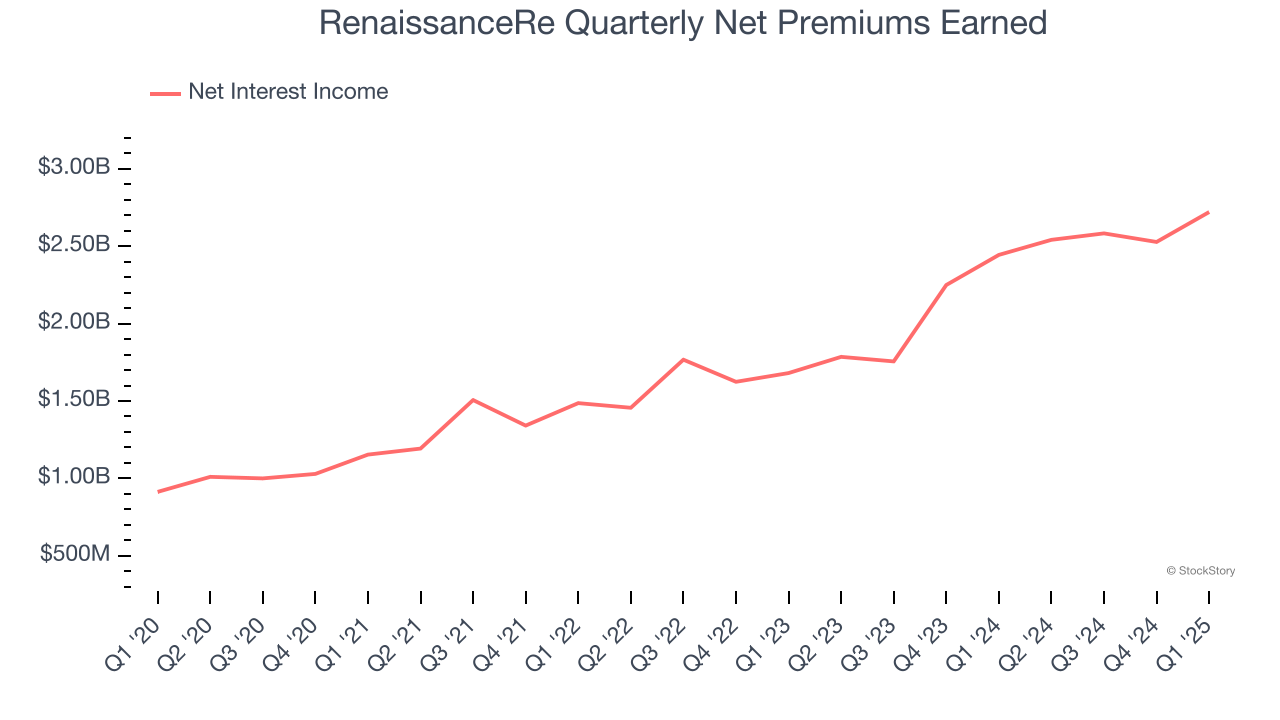

Our experience and research show the market cares primarily about an insurer’s net premiums earned growth as investment and fee income are considered more susceptible to market volatility and economic cycles.

RenaissanceRe’s net premiums earned has grown at a 26.1% annualized rate over the last two years, much better than the broader insurance industry.

2. Growing BVPS Reflects Strong Asset Base

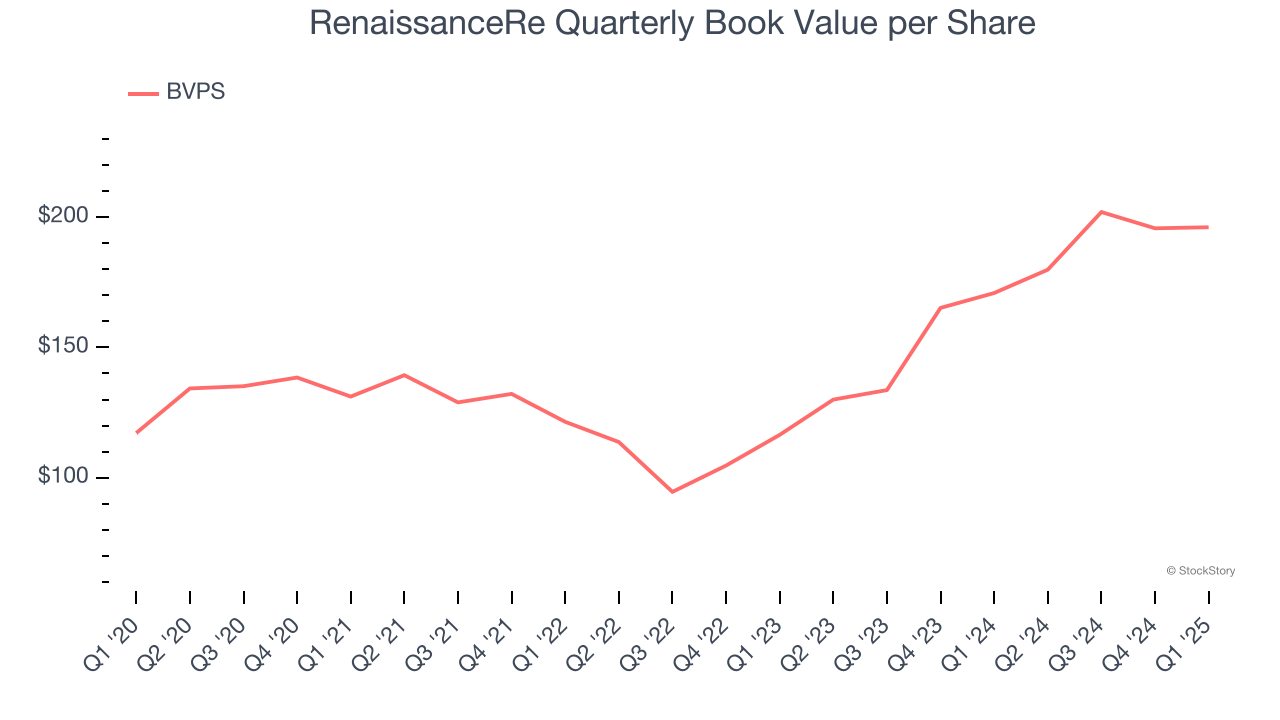

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

RenaissanceRe’s BVPS increased by 10.9% annually over the last five years, and growth has recently accelerated as BVPS grew at an incredible 29.8% annual clip over the past two years (from $116.44 to $196.17 per share).

One Reason to be Careful:

Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect RenaissanceRe’s revenue to drop by 5.2%, a decrease from its 40.2% annualized growth for the past two years. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Final Judgment

RenaissanceRe has huge potential even though it has some open questions. With the recent decline, the stock trades at 1.1× forward P/B (or $237.46 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than RenaissanceRe

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.