Shopify Ranks Highest in Merchant Services Customer Satisfaction for Second Consecutive Year

Small business owners are less optimistic than they were a year ago and, as they accept a wider variety of payment methods such as debit and credit cards, digital wallets, Buy Now, Pay Later (BNPL) and even cryptocurrency, many are applying surcharges to customer purchases. According to the J.D. Power 2025 U.S. Merchant Services Satisfaction Study,℠ released today, 34% of merchants are adding surcharges for customer purchases made using credit cards. Accordingly, satisfaction with the overall cost of payment processing services among small businesses that implement these credit card surcharges is 24 points lower (on a 1,000-point scale) than among those that do not add a credit card surcharge.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250114895436/en/

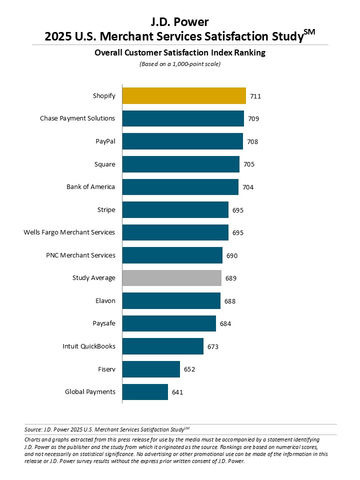

J.D. Power 2025 U.S. Merchant Services Satisfaction Study (Graphic: Business Wire)

“Small business owners are under pressure from both technological and economic perspectives, and as they continue to expand the number and type of payment options they accept, many are seeking more support and guidance from their merchant services providers and passing along their processing costs to customers,” said John Cabell, managing director of payments intelligence at J.D. Power. “And customers are paying attention. Many retail customers—specifically, 41% of credit card users—say they decided not to use a card payment method at a large or small business because of a surcharge.”

Following are key findings of the 2025 study:

- Business outlook and cost satisfaction strained: Fewer than half (45%) of small business owners say their company is better off financially than it was a year ago, down from 48% a year ago. Although satisfaction with cost is significantly lower among businesses that view themselves as worse off (508 for worse off vs. 692 for better off), small businesses that say they are better off are slightly more likely to levy surcharges on their retail customers.

- Growth in payment processing: Meanwhile, more sales than ever are being processed by third-party merchant services providers. A total of 65% of small business annual sales revenue was processed by merchant services providers in the 2025 study, up from 62% in 2024. Debit and credit cards continue to be the most popular forms of point-of-sale payment, accepted by 96% of small businesses. Digital wallets (90%); cash (81%); check (60%); and BNPL (52%) follow. Currently, 15% of merchants accept cryptocurrency, which is a significant drop from 20% in 2024.

- Many small businesses add surcharges for card purchases: With the increased reliance on payment processing comes increased service fees. For example, 34% of merchants now add a retail customer surcharge for credit card transactions. Processor pricing structure may have a role. Pricing based on a flat rate per transaction prompts significantly more merchants to add surcharges for credit cards. Newer and smaller merchants also are more likely to pass along these costs to their customers.

- Cash App Pay, Venmo, Apple Pay, Visa, Discover and Samsung Pay show significant gains in acceptance: The most widely accepted payment brands by small businesses are Visa (87%); Mastercard (82%); PayPal (73%); American Express (69%); Apple Pay (65%); and Discover (61%). Those brands showing the most significant growth in merchant acceptance in this year’s study are Cash App Pay (+8 percentage points); Venmo (+8); Apple Pay (+7); Visa (+6); Discover (+5) and Samsung Pay (+5).

- Data security/protection and advice/guidance emerge as areas for improvement: Specific areas in which small business satisfaction with merchant services providers declines most notably year over year are data security and protection and advice and guidance on running your business—both of which indicate businesses increasingly face growing pains about adopting new payment methods and desire for providers to deliver more hands-on support when payment fraud occurs.

Study Ranking

Shopify ranks highest in merchant services satisfaction for a second consecutive year, with a score of 711. Chase Payment Solutions (709) ranks second and PayPal (708) ranks third.

The U.S. Merchant Services Satisfaction Study is based on responses from 3,841 small business customers of merchant services providers and measures satisfaction across six dimensions (in alphabetical order): advice and guidance on running your business; cost of processing payments; data security and protection; managing my account; payment processing; and quality of technology. The study was fielded from August through October 2024.

The brands evaluated are the U.S. merchant services providers with largest market shares. Overall satisfaction results reflect overall corporate results, meaning they can include the results of various sub-brands or alternate brand names that operate under the respective corporate brand names. In some cases, brands profiled also currently have or recently have had joint partnerships to provide merchant services to small business clients.

For more information about the U.S. Merchant Services Satisfaction Study, visit

https://www.jdpower.com/business/merchant-services-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2025002.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20250114895436/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com