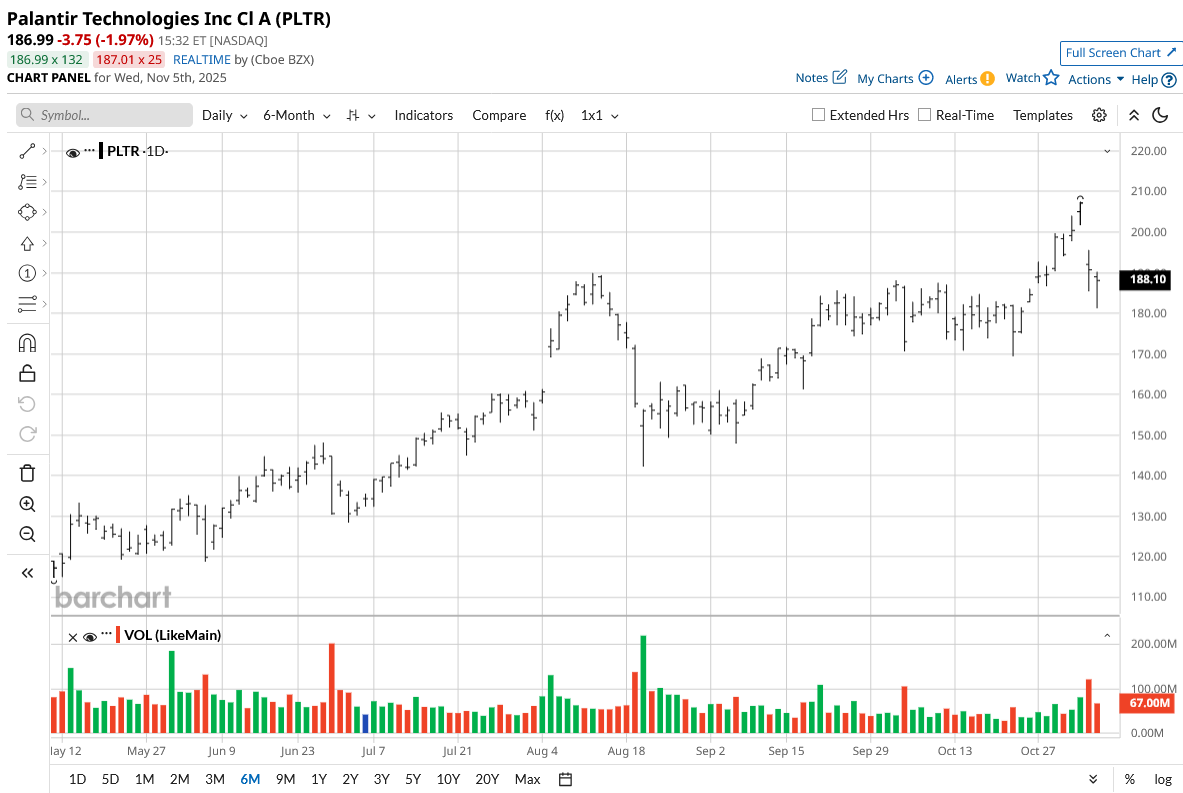

Palantir (PLTR) stock has rallied by 150% for the year as investors bet big on AI-related stories. The massive rally has been in sync with growth in revenue and cash flows.

The positive results trend continued in Q3, with numbers beating estimates. However, a sharp rally before earnings has translated into profit booking.

While the guidance for the remainder of 2025 remains robust, there is a case for some price and time correction before PLTR stock trends higher again.

About Palantir Stock

Palantir, with four principal software platforms—Gotham, Foundry, Apollo, and the Artificial Intelligence Platform—has been on a high-growth trajectory.

For Q3 2025, the company reported revenue of $1.18 billion, with the U.S. commercial segment being the key growth driver. Further, government contracts and revenue from international markets have also supported the company’s overall growth.

With AI themes being in the limelight through 2025, PLTR stock has trended higher by 52% in the last six months.

Robust Growth in Q3 2025

Palantir delivered strong results and an earnings beat in Q3. The company’s revenue increased by 63% on a year-on-year (YoY) basis to $1.18 billion. U.S. commercial and government revenue increased by 121% and 52%, respectively.

Besides the headline numbers, Palantir reported the highest ever quarter of total contract value (TCV) at $2.8 billion. On a YoY basis, the TCV surged by 151%, with the key growth catalysts being commercial TVCs.

Another critical factor when considering valuations is the cash flow potential. Palantir reported adjusted free cash flow of $540 million for Q3. Further, the company has guided for adjusted FCF of $2 billion for FY 2025.

Considering the company’s growth trajectory, it’s likely that FCF will continue to swell. As of Q3, Palantir reported cash and equivalents of $6.4 billion. With high financial flexibility, investment in research and development will drive long-term value creation.

International Expansion to Support Growth

For Q3 2025, Palantir reported $883 million in revenue from the United States. This implies almost 75% of the total revenue. With Palantir having an expanding presence in global markets, there is ample scope for growth acceleration.

Recently, the company announced its first partnership in the UAE to drive AI-powered transformation across the public and private sectors. Similarly, the partnership with Hadean, a UK-based AI and data firm, is targeted towards bringing a suite of simulation products for the UK's armed forces.

In August, the company signed a licensing agreement with Fujitsu (FJTSY) to support the integration of generative AI into the latter’s business operations. These collaborations underscore Palantir’s global reach, and as AI adoption accelerates across countries and businesses, the company is positioned to benefit.

What Analysts Say About PLTR Stock

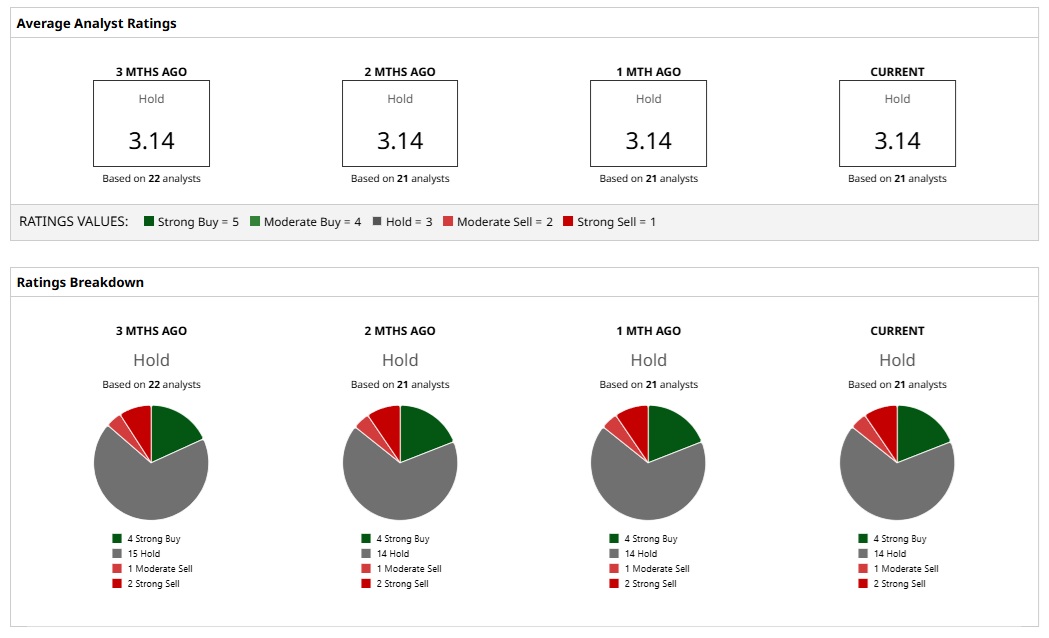

Based on the view of 21 analysts, PLTR stock is a “Hold.” While four analysts opine that the stock is a “Strong Buy,” the majority of them, 14, have assigned a “Hold” rating. The remaining three give it either “Moderate Sell” or “Strong Sell.”

Further, the mean analyst price target of $161.44 implies a downside potential of 14%. The sharp rally in the last few quarters has therefore translated into stretched valuations.

In October, Goldman Sachs listed 30 stocks with signs of froth, and the list included Palantir. Recently, Michael Burry, known for his bet against the U.S. housing market in 2008, initiated bearish bets on Nvidia (NVDA) and Palantir. The view on stretched valuations is also underscored by the point that PLTR stock currently trades at a price-earnings-to-growth ratio of 10.9. While earnings growth for FY 2025 is expected at 475%, it's likely to moderate to 30.4% in FY 2026. The PEG ratio is therefore expected to remain on the higher side.

Having said that, the most bullish analyst price target of $230 implies an upside potential of 23%. Overall, some correction in PLTR stock would be a good accumulation opportunity.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 High-Risk, High-Reward Way to Trade Earnings with 0DTE Options

- Is This ‘Strong Buy’ Aerospace Stock a Giant Steal in 2025?

- Alex Karp Says ‘We Were Right, You Were Wrong’ as Palantir Delivers Record Revenue. Should You Buy PLTR Stock Here?

- Cisco Just Got a New Street-High Price Target. Should You Buy CSCO Stock Here?