Nvidia (NVDA) shares are slipping on Nov. 11 after the Japanese multinational investment holding firm, SoftBank (SFTBY), confirmed it has sold its entire stake in the AI chip giant for $5.83 billion.

However, Citi’s senior analyst Atif Malik recommends buying NVDA on the pullback, saying it’s headed for $220 in the near term, indicating potential upside of another 15% from here.

Despite today’s weakness, Nvidia stock remains up more than 100% versus its year-to-date low.

Why SoftBank’s Divestiture Isn’t Negative for Nvidia Stock

SoftBank divesting its stake appears bearish for NVDA stock at first glance, but it doesn’t undermine confidence in the company’s long-term fundamentals.

Instead, it’s a part of a broader capital reallocation strategy, aimed at funding SoftBank’s next wave of artificial intelligence investments.

In a statement on Tuesday, the investment firm’s chief of finance, Yoshimitsu Goto, confirmed the sale was “so that the capital can be utilized for our financing,” not due to concerns about Nvidia’s valuation or growth trajectory.

The company’s product roadmap and AI chip leadership continue to warrant owning its stock for the long term.

Why Citi Remains Bullish on NVDA Shares

Citi recommends buying Nvidia shares ahead of the giant’s Q3 earnings scheduled for Nov. 19. Consensus is for it to record a 50% year-over-year increase in earnings to $1.17 a share in the third quarter.

Analyst Atif Malik expects the Nasdaq-listed firm to guide for $62 billion in revenue in the current quarter, reinforcing that concerns about an AI demand slowdown are rather overblown.

In his research note, he attributed the positive view to “NVDA’s announcement of already reaching 6M units of Blackwell” as well.

Note that Nvidia returns over 8% on average in November, which further bolsters the case for owning the AI stock ahead of its earnings print next week.

Nvidia Remains a ‘Buy’ Among Wall Street Firms

What’s also worth mentioning is that Citi is actually among the more conservative Wall Street firms on Nvidia stock.

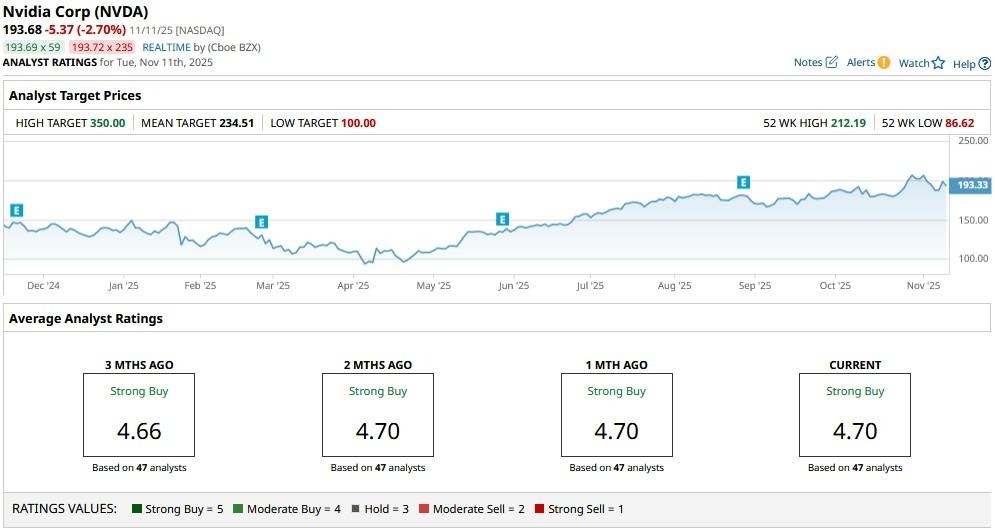

The consensus rating on NVDA shares currently sits at “Strong Buy” with the mean target of an even higher $235, indicating potential upside of roughly 23% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 40% in the Past 6 Months, Should You Buy, Sell, or Hold MicroStrategy Stock in November 2025?

- Opendoor Is Betting That It Can Become an AI Company. Does That Make OPEN Stock a Buy, or Should You Stay on the Sidelines Here?

- Peloton Is Betting on a Very Merry Christmas. Should You Buy PTON Stock Here?

- SoftBank Is Selling Nvidia Stock. Should You?